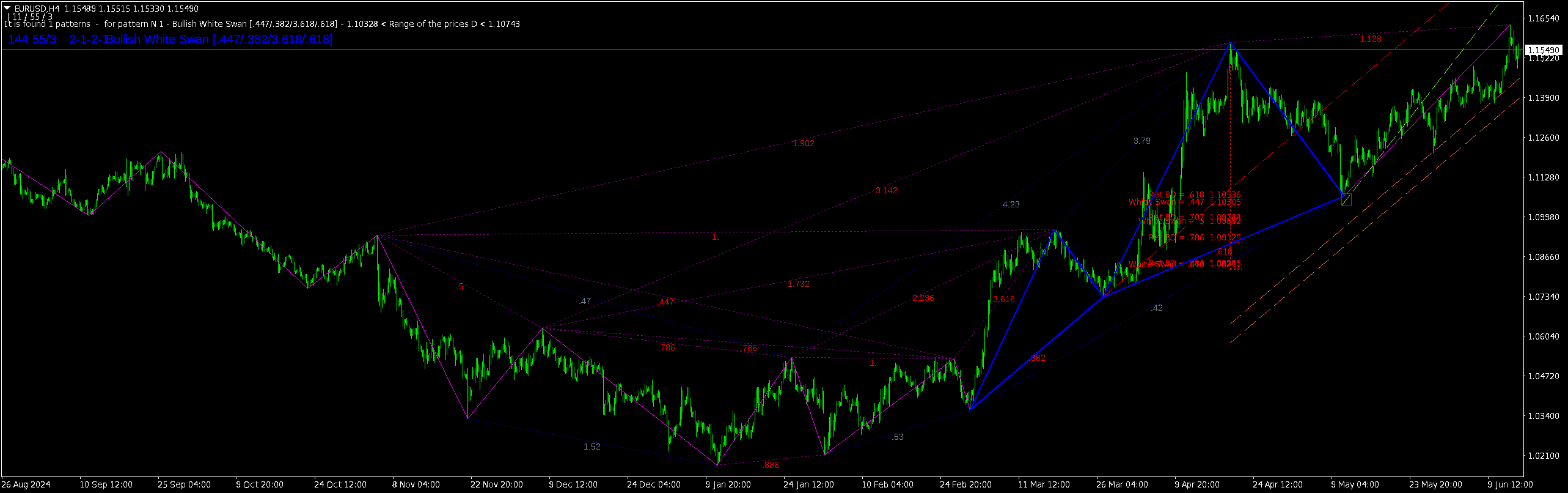

The EUR/USD 4-hour chart has recently confirmed the formation of a Bullish White Swan pattern, a powerful harmonic reversal setup. This pattern suggests a potential medium- to long-term bullish continuation following a significant corrective phase. As of the latest price action, EUR/USD trades around the 1.1549 level, maintaining a firm position above a dynamic ascending support channel and the critical D-point pivot.

Date of Analysis: June 15, 2025

Timeframe: H4 (4-Hour Chart)

Pair: EUR/USD

Pattern Identified: Bullish White Swan [.447/.382/3.618/.618]

Pattern Breakdown: Bullish White Swan

The Bullish White Swan pattern identified here follows the harmonic ratios of:

- AB retracement: 0.447

- BC retracement: 0.382

- CD projection: 3.618

- XA retracement at D: 0.618

This formation is highly rare and represents a deep harmonic structure. It often emerges at the end of a strong downtrend and indicates that institutional accumulation may be underway.

Key Structural Points:

- Point A: ~1.094 (significant low)

- Point D (completion): ~1.103

- Current Price: 1.1549

- Breakout Confirmation: Post-D point breach of 1.128 resistance

Price Action & Technical Indicators

Following the D-point completion in late April 2025, the pair experienced a sharp rally, pushing above key Fibonacci confluence levels. The most notable breakout occurred above the 1.128 resistance, validating the bullish reversal and signaling strong momentum.

Additional technical highlights:

- The blue harmonic legs clearly outline the symmetry of the White Swan structure.

- A secondary bullish channel (drawn in dashed brown lines) supports the ongoing trend.

- The price is trading well above previous swing highs, suggesting healthy bullish continuation dynamics.

Trade Implications

For Swing Traders:

- Entry Zone: Ideal re-entry or scaling zone would be around the 1.128–1.135 range

- Target 1: 1.1654 – psychological resistance and recent swing high

- Target 2: 1.1800 – long-term extension of CD projection

- Stop Loss: Below 1.103 – invalidates the bullish reversal

For Intraday Traders:

- Look for bullish flag or descending wedge patterns near the channel support for continuation setups.

- Avoid shorting unless a confirmed break below the D-point occurs.

Risk Management Considerations

As the EUR/USD remains within a broader uptrend post-pattern completion, traders should monitor:

- U.S. economic data affecting the dollar index (DXY)

- ECB monetary policy developments

- Geopolitical tensions that could trigger flight-to-safety moves

Final Thoughts

The Bullish White Swan pattern on the EUR/USD H4 chart is a rare but highly reliable signal of bullish continuation. With strong technical confluence and confirmed breakout levels, traders are positioned to benefit from the ongoing upward momentum. Conservative traders may await a pullback to re-enter, while aggressive positions are already in-the-money since the D-point breakout.

Disclaimer: As informações deste artigo servem apenas para fins educacionais e não constituem recomendação de investimento. Toda operação envolve riscos e é importante que cada trader adeque as estratégias ao seu perfil.